Extending credit to foreign customers is often required to be able to compete in foreign markets. However, this exposes exporters to the risk of non-payment. Political risks that can cause foreign customers to default include currency inconvertibility (foreign buyers' inability to obtain U.S. dollars), currency devaluation, war, revolution, cancellation of import/export licenses, foreign government action preventing the import of products, and diversion of voyage. Also, foreign companies may become insolvent or bankrupt, have cash-flow problems, or other commercial problems that could cause them to default or just take a very long time to pay. Export credit insurance (also referred to as trade credit insurance) can protect against these risks.

Benefits of Export Credit Insurance:

Export Credit Insurance can help your company:

- Increase foreign sales

- Foreign customers may want you to extend credit.

- Their access to capital may be limited.

- Interest rates in their country may be very high.

- Strengthens relationships with foreign customers

- Ensure You Get Paid

- Export Credit insurance provides protection against the risk of default, allowing you to safely extend credit to foreign buyers.

- Improve Financial Performance

- When do you recognize income? When the sale is made or when your get paid? Accounting standards allow for income from credit-insured sales to be recognized when the sale is made.

- Credit insurance improves financial performance, improves cash flow, reduces days sales outstanding and reserves for bad debts and improves return on assets.

- Finance foreign sales

- Most banks will not allow foreign accounts receivable as collateral in your borrowing base.

- Insuring foreign accounts receivable makes them eligible to be included in the borrowing base.

- Improve cash flow and liquidity by borrowing against insured foreign accounts receivable.

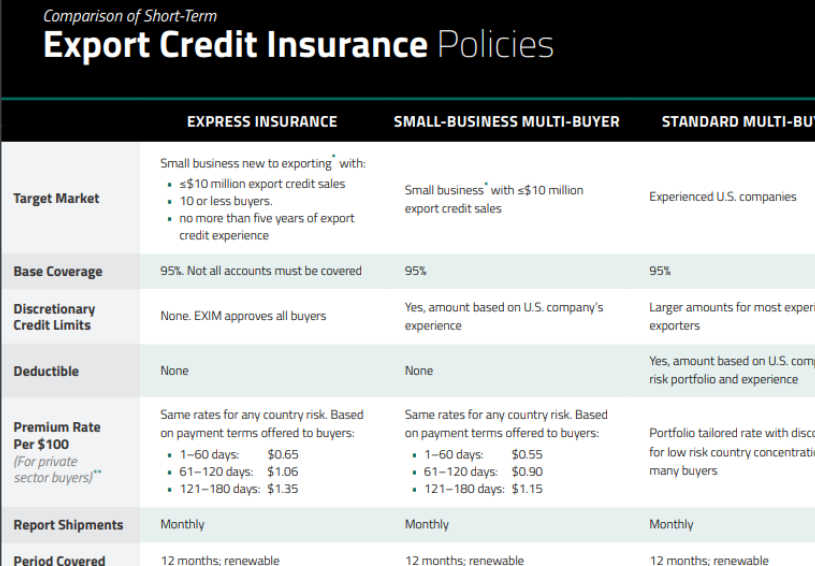

Policy Types - Policies can be arranged to cover:

- All foreign and domestic buyers (Global Policy)

- All foreign buyers

- Key accounts

- A single buyer

- Top up (Excess of Primary)

- Multi-insurer syndicated

Policy Terms and options:

- No deductible

- Deductible - either per policy year or per claim

- Indemnity (amount covered) - 90% - !00%

- Comprehensive or Political Risk Only Coverage

- Premium charged on covered sales or on coverage limits

- Premium rates are set primarily on payment terms and country of the buyer.

- Rates are normally a fraction of 1% of covered sales.

- Prepaid policies - where premium is charged up front based on estimated sales

- Pay-as-you-go policies - where premium is paid on the prior month's covered sales

Trade Credit Insurers:

- ACE

- AIG

- Atradius

- Coface North America

- EulerHermes

- FCIA (Great American Insurance Company)

- HCC Credit Group

- Lloyds of London

- Markel

- XL Group

- Zurich Insurance Company