Insurance on direct loans to foreign companies

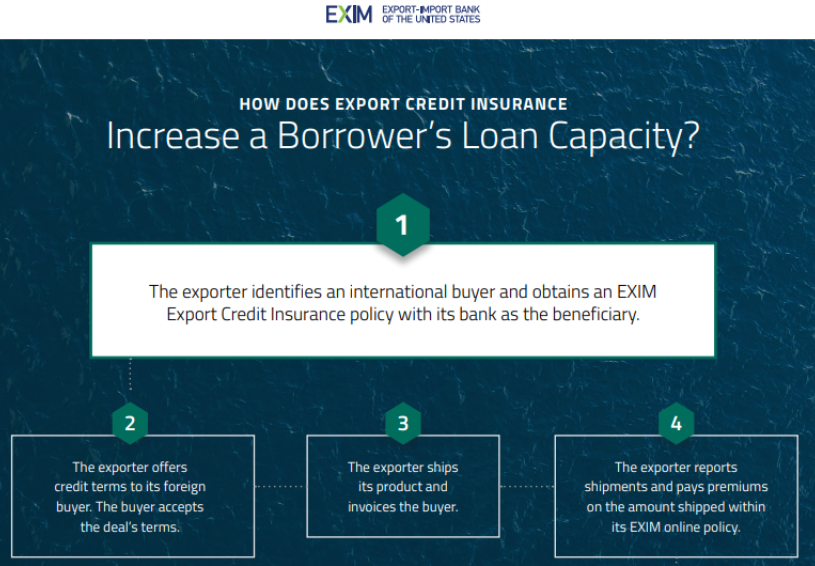

Opportunities for U.S. banks to make direct loans to companies in foreign countries are potentially profitable, but banks must deal with the challenges of the additional political risks and foreign commercial risks. Credit insurance through Ex-Im Bank and the private-market credit insurers is available to cover these risks.

Insurance on Short-Term Loans to Foreign Companies - Coverage can be arranged to protect a bank's short-term (up to 1 year) loans to foreign companies. The loans may be set up either on a revolving or transactional basis to finance the foreign buyer's imports from a single or multiple U.S. suppliers.

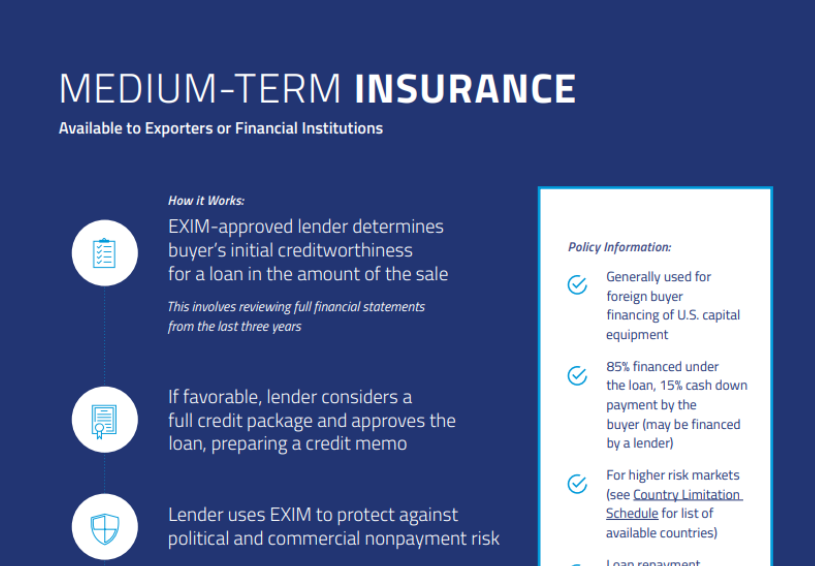

Insurance on Medium-Term Loans to Foreign Companies - We can arrange for insurance to cover financial institutions' medium-term (up to 5 years) loans to foreign borrows. The loan proceeds must be used by the borrower to purchase capital equipment. Coverage through Ex-Im Bank insures 100% of the loan amount with no deductible.

Bank Letter of Credit Policy - We are able to arrange coverage for banks against the failure of overseas banks (issuing banks) to pay or reimburse the insured banks on irrevocable letters of credit. Coverage is available to protect against political and commercial risks as causes of default.